The dispute centres on alleged failures in remitting statutory employee contributions to Nigeria’s National Housing Fund (NHF), resulting in financial loss, legal action, and reputational risk. This white paper examines the legal issues raised in the case, explores the systemic risks of payroll outsourcing, and offers actionable recommendations for global companies.

Category: Analysis

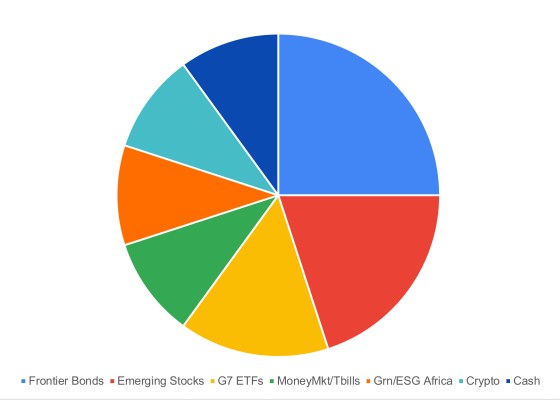

A Guide to Diversifying Retail Portfolios in Emerging and Frontier Markets

Our new ebook! Falling interest rates in the more developed economies of the world provide, not just an opportunity for … More

Nigeria’s real estate surge driven by illicit financial flows

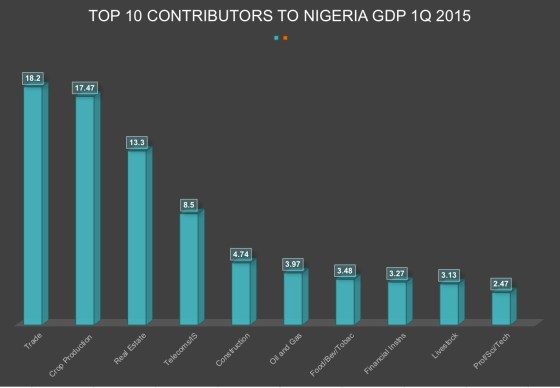

Nigeria’s real estate sector has surpassed petroleum in GDP contributions, reflecting economic diversification. Factors behind this boom include significant illicit financial flows and remittances. Despite economic contractions, real estate investments have thrived, with many properties remaining vacant. Government efforts to address the housing deficit face challenges regarding property rights and ownership transparency.

Nigeria Rediscovers the Niger River

Penny Wisdom By Emeka Uzoatu The Niger River, in case you’re unaware, is the second longest body of flowing water … More

Nigeria’s Betting Explosion and the Pie in the Sky

Money Palaver By George Eze Emeghara There was this radio jingle several decades ago , which sang ” For this … More

What’s Naira’s Real Exchange Rate?

By Our Reporters Tuesday, 6 October 2020 The answer to this headline question depends on the respondent. As at today, … More

The Tax Monster Chasing Small Businesses

Penny Wisdom By Emeka Uzoatu Had to pinch myself the other day as it slowly dawned on me that the … More

Retirement: When Delay is Preferred

Money Palaver By George Eze Emeghara It used to be that people looked forward to retiring. It was chance for … More

Buharinomics Corners Nigerian Pension Funds

By Chuks Emele Friday, 25 September 2020 Nigerian pension funds are in a quandary. They’re fighting a lost battle to … More

One Thing Covid-19 Can’t Take Away

Penny Wisdom By Emeka Uzoatu Hi. You there? Today I come with differential tidings. One borne out of a slip … More

Revenue Agents: a Growing Menace

Money Palaver By George Eze Emeghara Last week two videos went viral. One showed a poultry farmer who lost newly … More

Turning Tides and an Old Adage

Penny Wisdom The going maxim since the dawn of time has been: Penny wise, Pound stupid. Only God knows why … More

The Depositors’ Dilemma as Ponzi Schemes Beckon

With inflation said to be running at about 15 percent, a deposit of one million naira in January 2020 will earn 15,000 naira in interest after one year. It will also lose 150,000 naira to inflation, giving a net loss in value of 135,000 naira. When the effects of currency devaluation are factored in, the situation becomes even more dire.

How Nigeria’s Central Bank is Eroding Savings

By Our Staff Writers Nigerians saving money in the national currency, the naira, have been facing a unique situation since … More

Fasten Your Seat Belt for Nigeria’s Exchange-Rate Storm

ANALYSIS Keeping up with President Muhammau Buhari’s exchange-rate policy these days may not be an easy task, given its departure … More