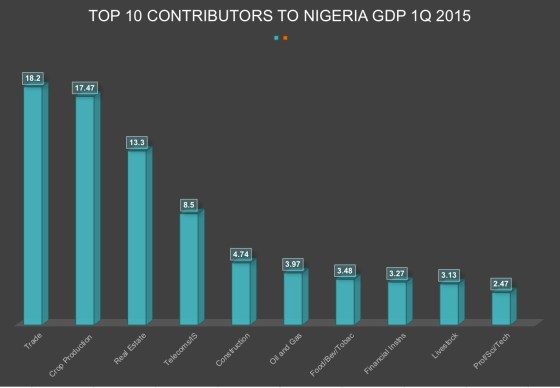

Nigeria’s real estate sector has surpassed petroleum in GDP contributions, reflecting economic diversification. Factors behind this boom include significant illicit financial flows and remittances. Despite economic contractions, real estate investments have thrived, with many properties remaining vacant. Government efforts to address the housing deficit face challenges regarding property rights and ownership transparency.

Tag: Nigerian forex

Markets at a Glance

Friday, 16 October 2020 EQUITIES • The All-Share Index rose 1.11% rose 28,659.45 with a market capitalization at 14.97 trillion … More

Markets at a Glance

Thursday, 15 October 2020 EQUITIES • The All-Share Index ended flat at 28,344.04 with a market capitalization at 14.81 trillion … More

Markets at a Glance

Wednesday, 14 October 2020 EQUITIES • The All-Share Index barely changed at 28,344.33 with a market capitalization at 14.81 trillion … More

Markets at a Glance

Thursday, 8 October 2020 EQUITIES • The All-Share Index fell 0.31% to 28,546.22 with a market capitalization at 14.92 trillion … More

Markets at a Glance

Wednesday, 7 October 2020 EQUITIES • The All-Share Index fell 0.95% to 28,634.35 with a market capitalization at 14.97 trillion … More

Markets at a Glance

Tuesday, 6 October 2020 EQUITIES • The All-Share Index gained 4.921% to 29,909.37 with a market capitalization at 15.1 trillion … More

Markets at a Glance

Monday, 5 October 2020 EQUITIES • The All-Share Index gained 2.11% to 27,554.49 with a market capitalization at 14.4 trillion … More

Newgold Fund is Nigeria Winner With 64% Gain

By Chuks Emele Monday, 5 October 2020 Newgold Exchange-Traded Fund put up a stellar performance on the Nigerian Stock Exchange … More

NSE Weekly Report

Friday, 2 October 2020 EQUITYThe market opened for four trading days this week as the Federal Government of Nigeria declared … More

Markets at a Glance

Friday, 2 October 2020 EQUITIES • The All-Share Index gained 0.57% to 26,985.77 with a market capitalization at 14.1 trillion … More

Lead Weekly Stock Recommendations

Monday, 21 Sepember 2020 ZENITH: Zenith bank showed commendable and resilient growth in its H1 2020 earnings, despite pressure on … More

Daily Market Wrap

Friday, 18 September 2020 EQUITIES • The All-Share Index fell rose 0.16% to 25,572.57, with market capitalization at 13.36 trillion … More

Nigerian Unions Threaten Strike Over Hikes in Energy Prices

By Bashir Olanrewaju The Nigerian Labour Congress, the country’s biggest trade-union federation, said it will begin an indefinite strike on … More

Daily Market Wrap

Wednesday, 16 September 2020 EQUITIES The All-Share Index fell 0.19% to 25,550.31, with market capitalization at 13.35 trillion naira. The … More

Daily Market Wrap

Tuesday, 15 September 2020 EQUITIES Nigerian equity market closed on a negative note today as All Share Index marginally decreased by … More

Nigeria’s Inflation Jumped to 13.2% in August on Food Costs

By Our Reporter Tuesday, 15 September 2020 Nigeria’s consumer price index jumped 13.3 percent in August from a year earlier, … More

Daily Market Wrap

Monday, 14 September 2020 EQUITIESThe Nigerian equity market closed on a positive note today as All Share Index marginally increased … More

Lead Weekly Stock Recommendations

Monday, 14 September 2020 ZENITH: Zenith bank showed commendable and resilient growth in its H1 2020 earnings, despite pressure on earnings … More

The Depositors’ Dilemma as Ponzi Schemes Beckon

With inflation said to be running at about 15 percent, a deposit of one million naira in January 2020 will earn 15,000 naira in interest after one year. It will also lose 150,000 naira to inflation, giving a net loss in value of 135,000 naira. When the effects of currency devaluation are factored in, the situation becomes even more dire.